amazon flex driver tax forms

1925 - 2500 an hour. Day shift 1.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How can I print my attachments.

. Ad We know how valuable your time is. Driving for Amazon flex can be a good way to earn supplemental income. Select Sign in with Amazon.

We would like to show you a description here but the site wont allow us. Knowing your tax write offs can be a good way to keep that income in your pocket. Home Estate Tax Forms Federal Estate Federal 1041 Illinois Estate New York Estate Inheritance Tax Forms Pennsylvania Indiana New Jersey Family Law Statement of Net Worth Workers Compensation Pennsylvania New.

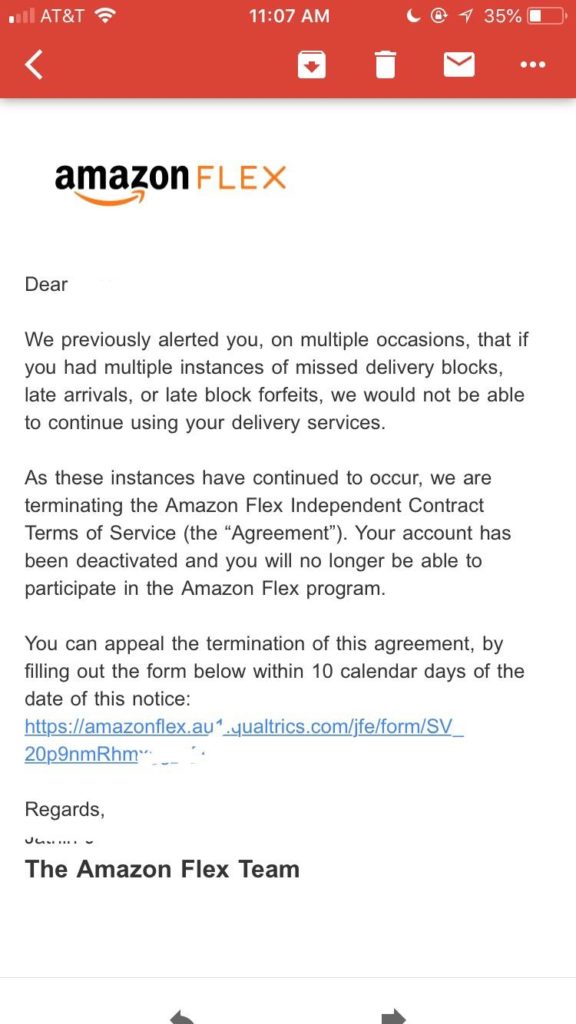

No matter what your goal is Amazon Flex helps you get there. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. A current and valid drivers license.

My additional answers didnt print. In order to fulfill the IRS requirements as efficiently as possible answer all questions and enter all information requested during the. Or download the Amazon Flex app.

BL McShipping Corp is company contracted by Amazon to deliver light package deliveries. Sign in using the email and password associated with your account. Delivery drivers have competitive compensation of at least 20 per hour at select stations.

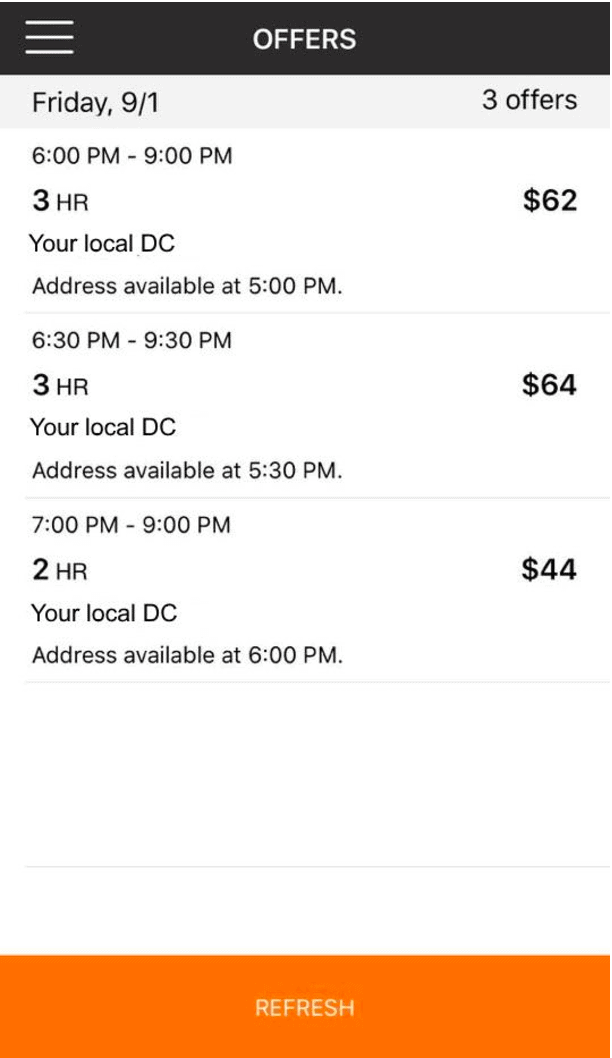

Amazon Flex drivers deliver goods and groceries ordered through programs like Prime Now and AmazonFresh which allow customers to leave tips for their drivers. With Amazon Flex you work only when you want to. Most drivers earn 18-25 an hour.

If you dont want to wait for your Amazon flex tax forms you have two options. Actual earnings will depend on your location any tips you receive how long it takes you to complete your deliveries and other factors. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone.

How can I get my entire answer to print on one page. Click Download to download copies of the desired forms. Gig Economy Masters Course.

A 1099 form is a series of documents the IRS calls an information return defined as a tax return that contains taxpayers identifying information but does not state their tax liability. Click ViewEdit and then click Find Forms. Whatever your goal is Amazon Flex can help you get there.

Amazon Flex is a self-employed delivery driver opportunity where you can use your own car SUV minivan or cargo van to deliver packages to Amazon customers using the Amazon Flex app. With the Bonsai. Although you do not physically need a printer connected to your computer you do need a driver set in Windows.

DSPs provide their team with full benefits such as paid time off and health insurance for full-time employees. Maybe you have a few hours spare on a weekend or are looking to turn your people mover into a money maker. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after.

The first option is to enter your income in your tax software as income you didnt receive a 1099 for. My form prints with Evaluation Copy stamped on it. 12 tax write offs for Amazon Flex drivers.

Tap Forgot password and follow the instructions to receive assistance. Get started now to reserve blocks in advance or pick them daily based on your schedule. Its even projected to.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am. While Amazon Flex driver pay is OK Amazon has a reputation for being willing to have high turnover due to its working conditions. My program locks up when I select to print.

Increase Your Earnings. Let Bonsai Tax Handle Your Amazon Flex 1099 Forms And All Other Self-Employed Taxes. And now participating DSPs are offering sign-on bonuses of 1000 2000 and 3000 to new delivery drivers in select cities.

1099 Forms Youll Receive As An Amazon Flex Driver. Get it as soon as Fri Feb 4. 1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC 25 Pack.

Amazon Delivery Associate Driver 1925-2300 Hr Starting P. Driven by always being there for storytime. Be able to lift 50 lbs.

Please follow steps.

Amazon Flex App Everything You Need To Know Full Tutorial Ridester

Help For Flex Drivers How To Get Results From Amazon Flex Driver Support Gridwise

How To Become An Amazon Flex Driver Hyrecar

How To Do Taxes For Amazon Flex Youtube

Everything You Need To Know About Amazon Flex Gridwise

Everything You Need To Know About Amazon Flex Gridwise

Amazon Flex Mileage Tracking Explained Triplog

Can You Really Make Money With Amazon Flex Amazon Flex Driver Review

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Drivers Ask Amazon To Help With High Gas Costs Protocol

Amazon Independent Contractor Requirements For 2022

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

What It S Like To Be An Amazon Flex Delivery Driver Youtube

7 Ways To Make More As An Amazon Flex Driver